Digital payment integration now easier for local businesses

Jamaican businesses, particularly micro and small enterprises (MSEs), will now find it easier to begin accepting digital payments with the assistance being offered through the Go-Digital website, a collaboration between the Jamaica Technology and Digital Alliance (JTDA) and the Development Bank of Jamaica (DBJ).

The website – www.godigitaljm.com – allows local businesses to research, contact and access services through tech firms, including companies that offer digital payment solutions.

Digital payments, which take place electronically without the physical exchange of cash, have become more common and even necessary for businesses during the COVID-19 pandemic.

President of the JTDA Stacey Hines said that while many small businesses still use bank transfers by sharing their account information in public spaces, this method is less favourable with the increase in cybersecurity breaches.

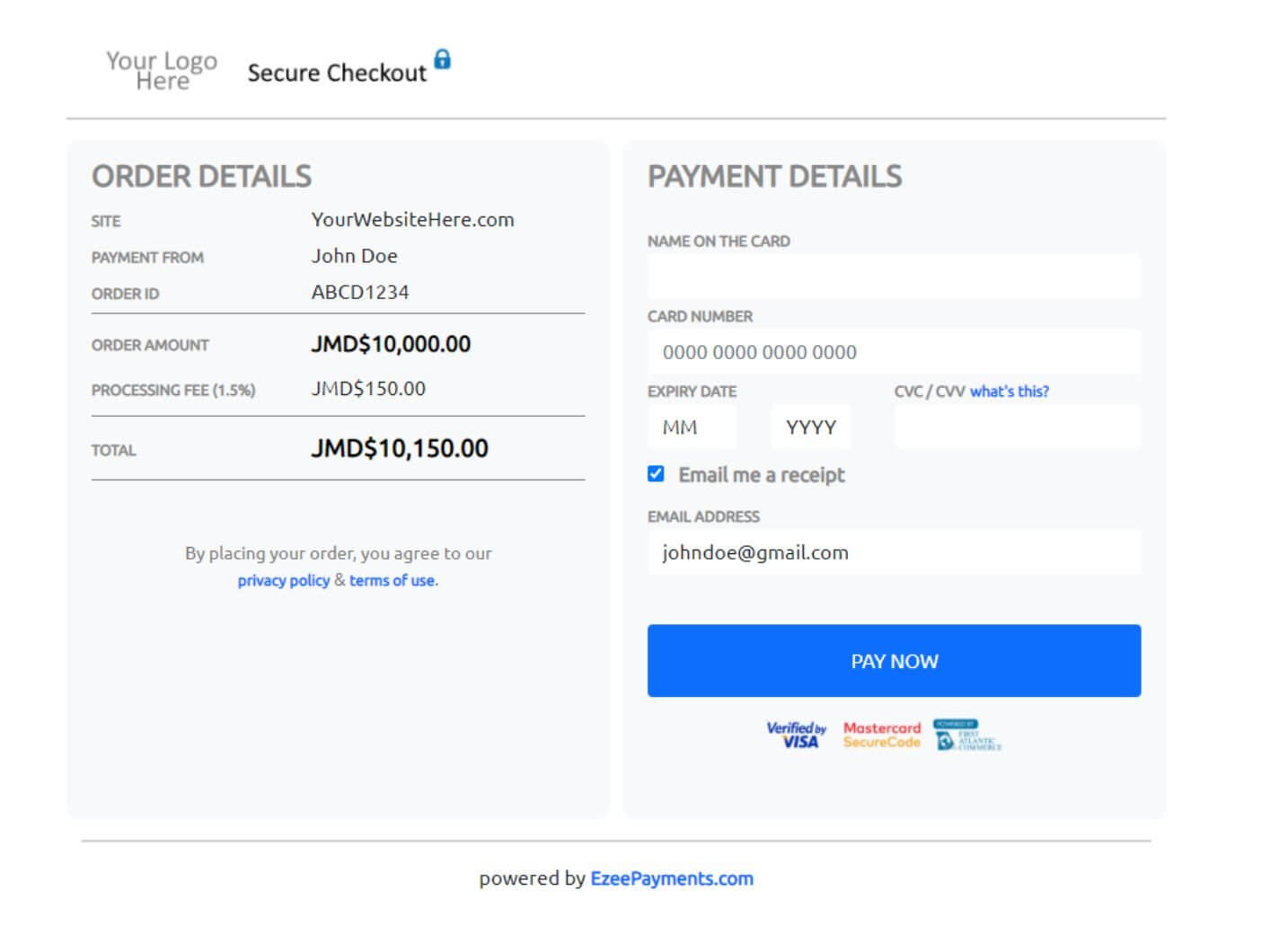

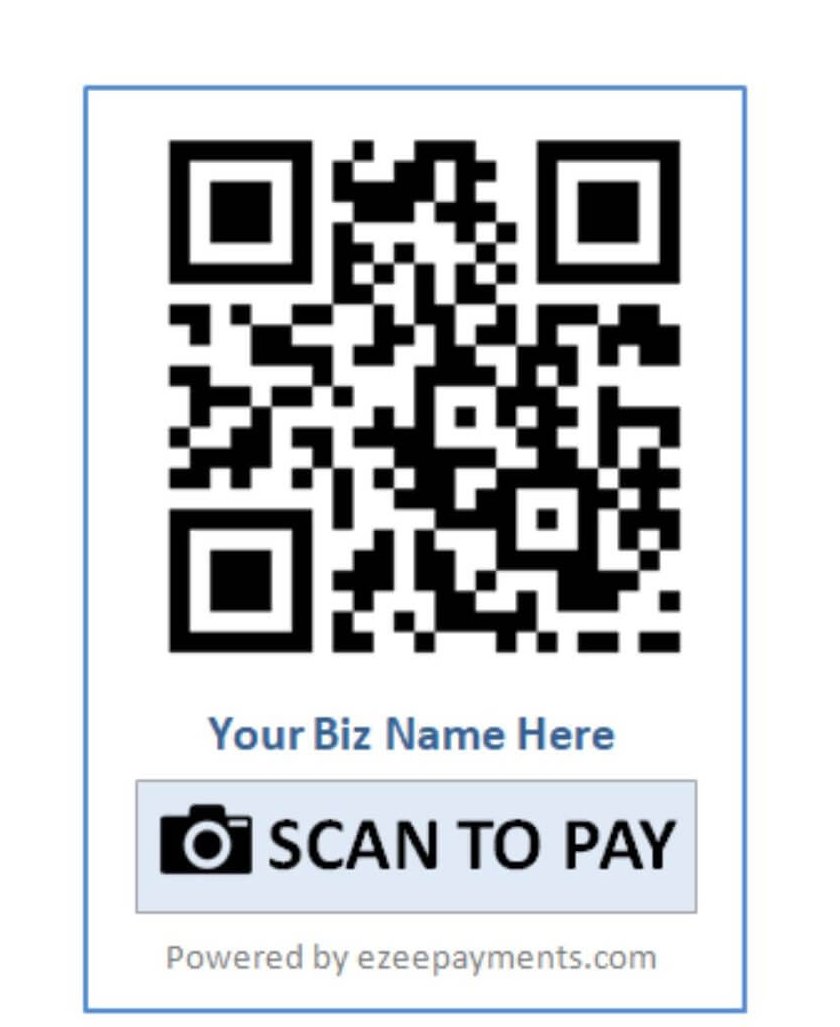

“What we would like to see more use of is payment gateways and apps,” she said while noting services such as WiPay Caribbean and Ezee Payments, which may be accessed through the Go-Digital website.

Both offer safe and simple methods for businesses, including individuals, to accept digital payments without having to have a website or a card machine.

Hines also suggested another option for businesses, particularly those with websites. “You may setup your own gateway by directly working with a bank. You can have a developer code the integration or the connecting of your platform with the bank so that you can accept credit card payments through that medium,” she said.

Businesses may find firms with this experience and these skills via the Go-Digital website.

Among the firms mentioned by Hines with experience in this field are DMA, Appfinity and Particular Presence. While the Go-Digital website connects businesses with the right IT service providers, the DBJ has also provided Go-Digital Vouchers, which are grants to pay for software and services received through providers listed on the website.

The grant will pay for 100 per cent of the cost of the service up to $300,000.

For services exceeding $300,000, there are two loans are available under the DBJ SERVE programme, the DBJ MSME Recovery Loan and the DBJ Go-Digital Loan, with the latter being geared towards digital transformation.

The DBJ Go-Digital Loan offers up to $800,000 at a two per cent interest rate and can be used to acquire computer hardware, software and digital transformation services through companies on the GoDigital website.

The DBJ Go-Digital loan can be accessed through DBJ’s network of approved financial institutions.

See more on https://jamaica.loopnews.com/content/digital-payment-integration-now-easier-local-businesses

Posts You May Like!

A Female Fintech Founder, An ‘Ezee’ Solution: Narda Ventura and Ezeepayments.com

Narda Ventura suffered a disappointing setback that curtailed the launch of her digital school fee payments solution in...

Narda Ventura — Making School Fees Ezee

Co-founder and Chief Executive Officer of ezeepayments.com, Narda Ventura, recounts that she wanted a more accessible and more...

Digital Payments Trending

The JTDA recently invited my business partner and EzeePayments.com CEO Narda Ventura and me to discuss digital payments...